Hello traders!!!!!

this week the market did exactly what I have been expecting - wave "A" to broke the neckline of a double bottom pattern and to see higher prices. On the weekly chart we have confirmed bullish engulfing and the histogram slope pointing upward. So for the next several weeks I am bullish and I am expecting to form a right shoulder of a Head&Shoulders topping pattern(Look at the first and second chart).

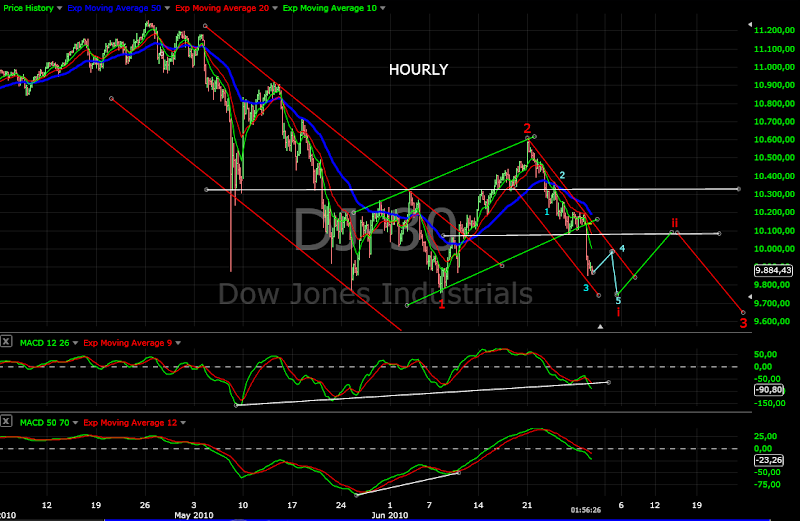

This is a corrective move so I expect some kind of zig-zag A-B-C (see the third chart). I think wave A is completed or we can see short lived rally on Monday to complete it. After that a pullback for several days 3 to 5 days, followed by final wave C to resistance 1(~10750) or resistance 2(~10900) to complete the right shoulder.

First - why to expect pullback and why just pullback and not next leg down?

I expect some kind of short lived pullback because:

- McClellan Oscillator hit extreme and is falling for the last 2 days (see the last chart)

- Histogram made very high tower and I expect the prices to cool down for several days

- The prices are hitting the EMA50 for the last 3 days finding resistance

- MACD Divergences on the hourly and 15-min charts

So it is wise to take some profits at this levels and wait for wave B when it is over to load up again.

Why not another leg down? - simple I do not see bearish signs at the moment.

- Daily MACD is pointing up

- Weekly histogram slope pointing up

- Bullish candle confirmed on the weekly chart

- Bullish percentage and McClellan Summation index pointing up

Second - what if I am wrong?

- If the prices just go higher and higher and make new highs... great we are on the right side of the trade:))))

- If that was wave 2 and this is the beginning of another leg down... so it be, we will follow the market. We do not have bearish sings(at least for the short term) so I will follow the signals which the market gives me. If it tells me something different next week I will change my bias right away:) - I will tell you, do not worry:)